Hello hello. It’s been a while. I began writing in 2012 and wrote till 2021. Ten years of writing without a break. I started with zero idea of where my journey was headed, zero reading skills, zero writing skills, zero knowledge, zero application in behavioural science, but slowly I read and wrote till it became a habit. There have been hundreds of behavioural scientists that have influenced me and whose work I still read, admire and implement, but Richard Thaler was the biggest one. Richard Thaler’s book ‘Nudge’ nudged me into starting behaviouraldesign.com. He won a Noble prize in 2017 after fifty years of work.

Over the past ten years, I have read over two hundred and fifty books mostly related to behavioural science and more than fifteen thousand behavioural science papers. I started writing blog posts and then moved on to writing editorials in The Economic Times, The Hindu and Mint.

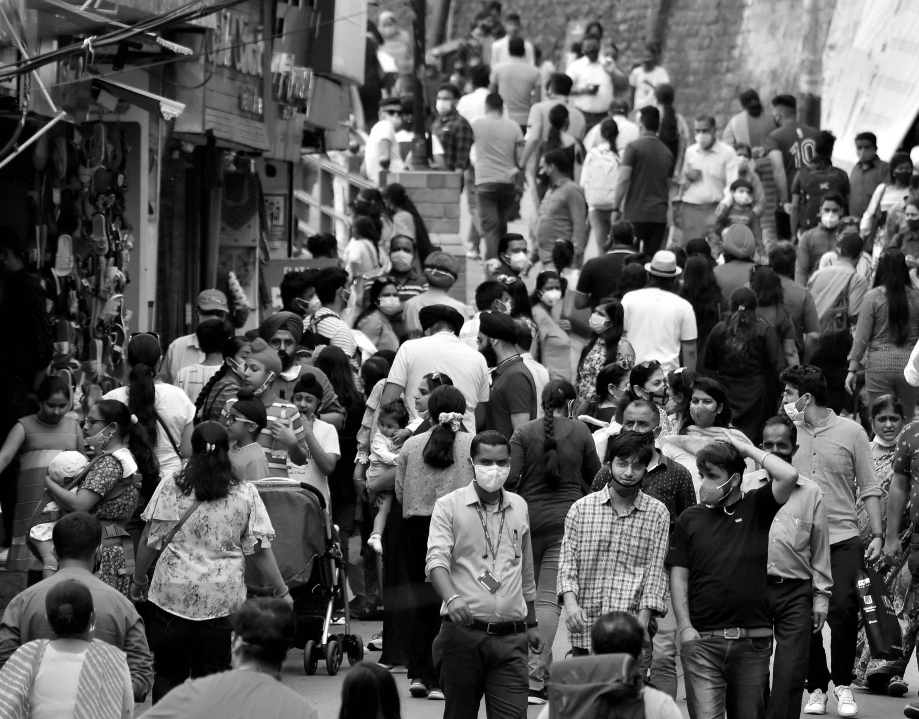

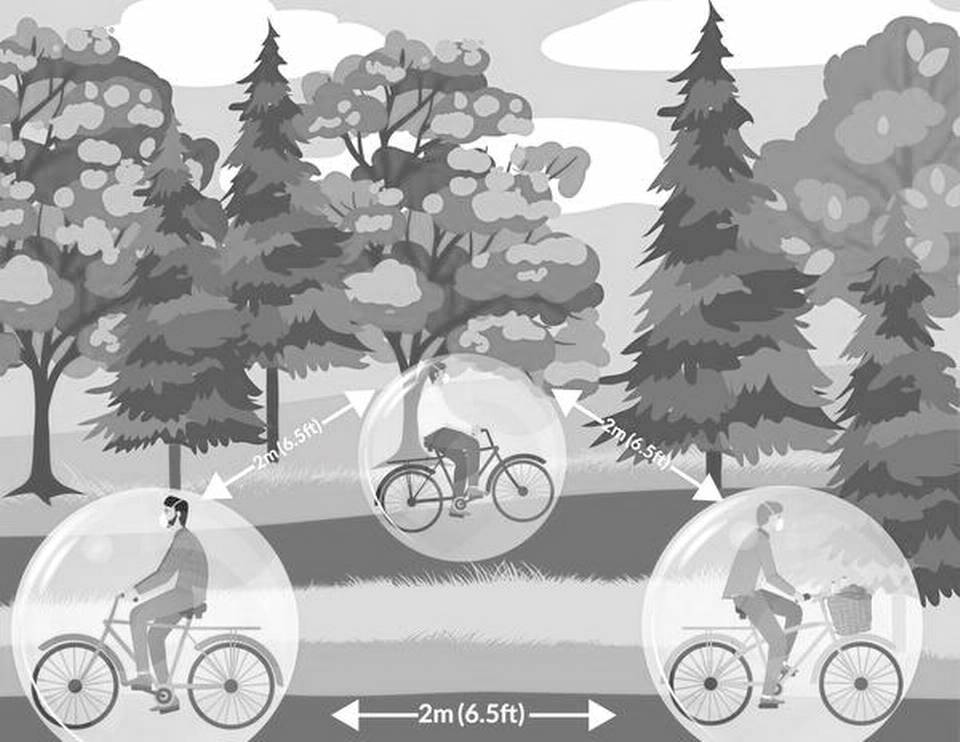

It’s been a super fun ride, I did some experiments that surprised me. I loved writing. I wrote about road safety, hand-washing, social distancing and even about the most taken-for-granted things like tooth-brushing and pee-ing. But even though I have written hundreds of unpublished articles, I don’t feel like writing anymore.

My goals have changed. My focus is now on multiplying my wealth and the wealth of people around me. I have been investing in India since 2015, but have taken it up rigorously since 2022. I also began investing in international stocks in October 2022. This time an investor named Chris Mayer has been my main inspiration. He’s the author of ‘100 baggers: Stock that return 100 to 1 and how to find them’. Of course there are hundreds of other inspiring investors that I read and follow. I cannot resist reading investing books, studying how businesses multiply wealth, and picking and holding the quality ones. Behavioural science has taught me half of what goes into investing – managing our own behaviour and now I’m obsessed with the other half – of picking quality businesses that will multiply wealth. I’m also building an AI product. That will be a new journey of growing it from zero to a full fledged business. Meanwhile I will continue doing projects, talks and workshops. I will be spending this decade on these goals.

I would like to thank my wife Evita who encouraged me to write and is now encouraging me to create wealth for us and others. Meanwhile, I would like to leave you with the ABCs of life – Always Be Curious. And if you have Patience, Discipline and Focus – PDF 🙂 you can achieve anything.

You can follow me on Instagram and Linkedin.